When a Job Is Completed the Journal Entry Involves a

It is a result of accrual accounting. When a job is completed and all costs have been accumulated on a job cost sheet the journal entry that should be made is a.

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

A reference number or also known as the journal entry number which is unique for every transaction.

. Debit to Work-in-Process Inventory account and a credit to the Finished Goods Inventory account. On December 7 the company acquired service equipment for 16000. The total cost of the product for Job MAC001 is 931 and the entry is.

Journal Entry to Move Work in Process Costs into Finished Goods When each job and job order cost sheet have been completed an entry is made to transfer the total cost from the work in process inventory to the finished goods inventory. There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase. This will result in a compound journal entry.

The accounting records are aggregated into the general ledger or the journal entries may be recorded in a variety of sub-ledgers which are later rolled up into the general ledger. Work In Process Inventory Direct Materials Direct Labor Manufacturing Overhead c. -When a job is completed the journal entry involves Debit to finished goods inventory account and credit to Work in Process inventory account-The journal entry needed to record the completion of a job includes a Credit to Work in process inventory account-The cost of direct labor used in production is recorded as a Debit to work in process inventory account-The.

When a job is completed the total cost of manufacturing the job should be moved to which of the following general ledger accounts. Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. B debit to finished goods inventory and a credit to work in process inventory.

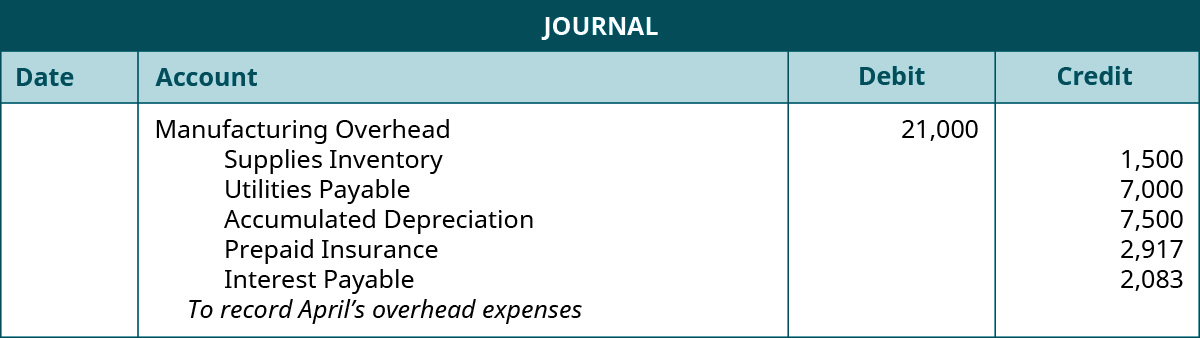

The journal entries follow the job costing process from purchase of raw materials allocation of direct materials direct labor and manufacturing overhead to work in process. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Finished Goods Inventory Direct Materials Direct Labor Manufacturing Overhead b.

Generally adjusting journal entries are made for accruals and deferrals as well as estimates. The job cost accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of job costing. Debit to Finished Goods Inventory account and a credit to Work-in-Process Inventory account.

The total job cost of Job 106 is 27950 for the total work done on the job including costs in beginning Work in Process Inventory on July 1 and costs added during July. An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business. A a debit to finished goods inventory and a credit to work in process inventory for the cost of the job B a debit to finished goods inventory and a credit to.

To make a complete journal entry you need the following elements. Finished goods Ac Dr XXXXX To Work in process Ac XXXXX Being the job is completed When a job is completed we debited the finished goods account as the job is completed and credited the work in process account so that the proper posting could be done Advertisement Survey. Debit to Cost of Goods Sold and a credit to the Finished Goods Inventory account.

47 When a job is completed in a job costing system the journal entry involves which accounts. The company paid a 50 down payment and the balance will be paid after 60 days. Journal entries are the way we capture the activity of our business.

Two separate columns for debit and credit. The account column where you put the names of the accounts that have changed. Raw Materials Inventory Work In Process Inventory d.

A debit to work in process inventory and a credit to finished goods inventory. 1 Answer to 51 When a job is completed the journal entry involves a. Debit to Finished Goods Inventory account and a credit to WorkinProcess Inventory account.

The date of the journal entry. Having the skills to record and understand journal entries is essential in any career in accounting whether you are involved in public practice and are working on a clients audit file or you are working in an industry and helping to prepare a companys financial statements. When a job is completed in a job costing system the journal entry involves which accounts.

And follows the matching and revenue recognition principles. A a debit to finished goods inventory and a credit to work in process inventory for the cost of the job B a debit to finished goods inventory and a credit to work in process inventory for the sales price of the job C D. When a job is completed the journal entry involves a.

When a job is completed the journal entry involves a. This lesson will cover how to create journal entries from business transactions. This entry records the completion of Job 106 by moving the total cost FROM work in process inventory TO finished goods inventory.

The journal entry to record when a job is completed is shown below.

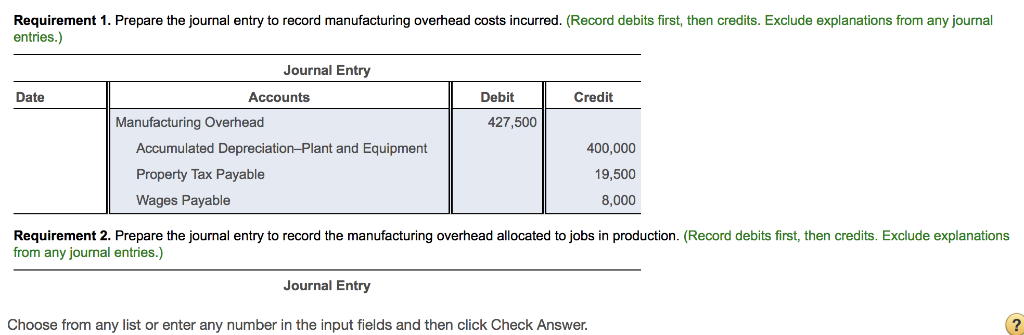

Solved Requirement 1 Prepare The Journal Entry To Record Chegg Com

This Is An Example Of A 4th Grade Student S Espark Journal Which Includes Her Daily Journal Entry Bottom And A Complet Journal Entries Encouragement Student

Job Order Costing Journal Entries Youtube

Pass Journal Entries For The Followings I Interest Due But Not Recevied Rs 4 000 Ii Salaries Youtube

No comments for "When a Job Is Completed the Journal Entry Involves a"

Post a Comment